Embedded

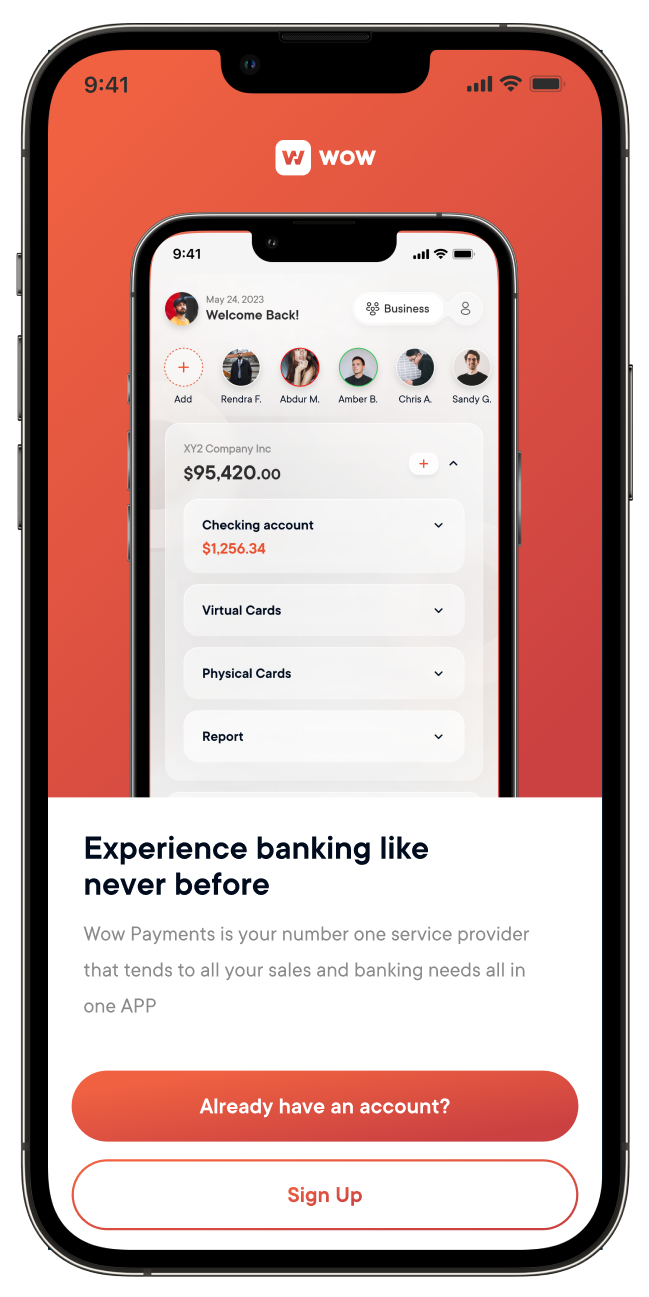

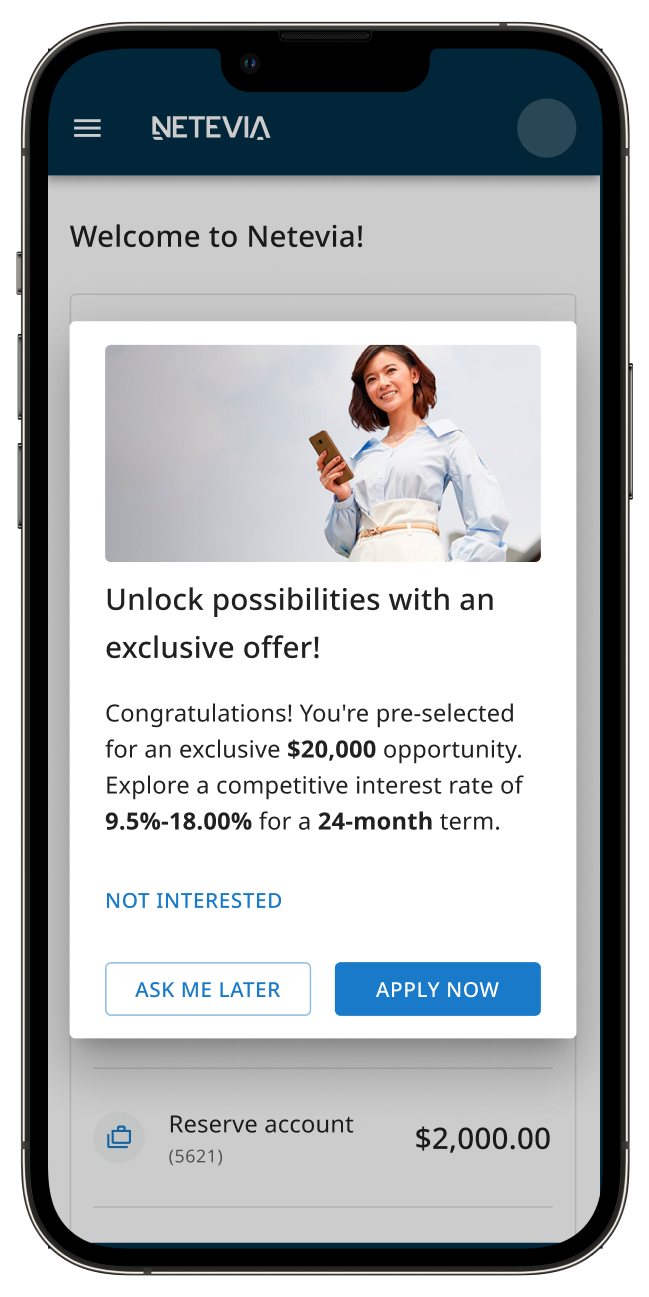

Financial Services

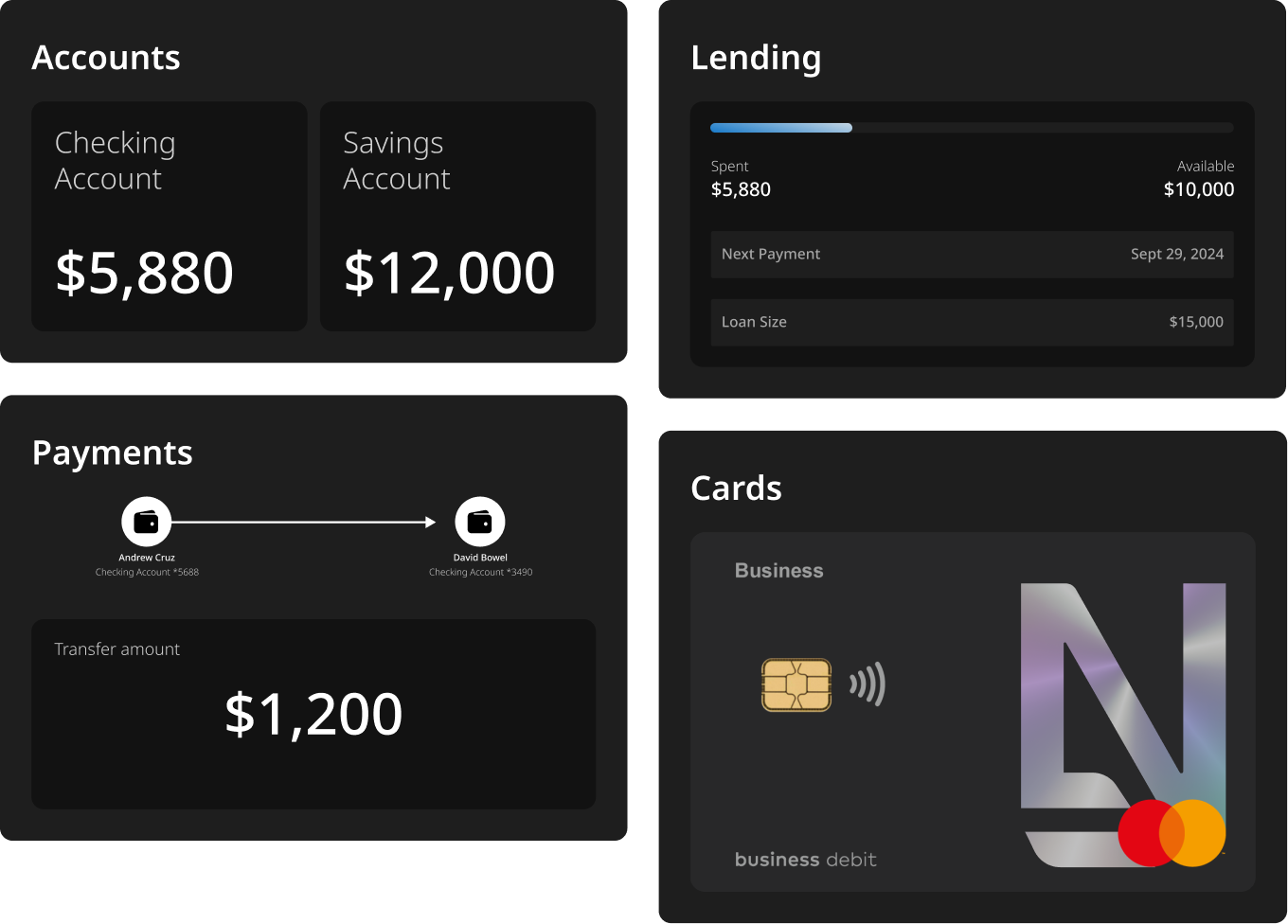

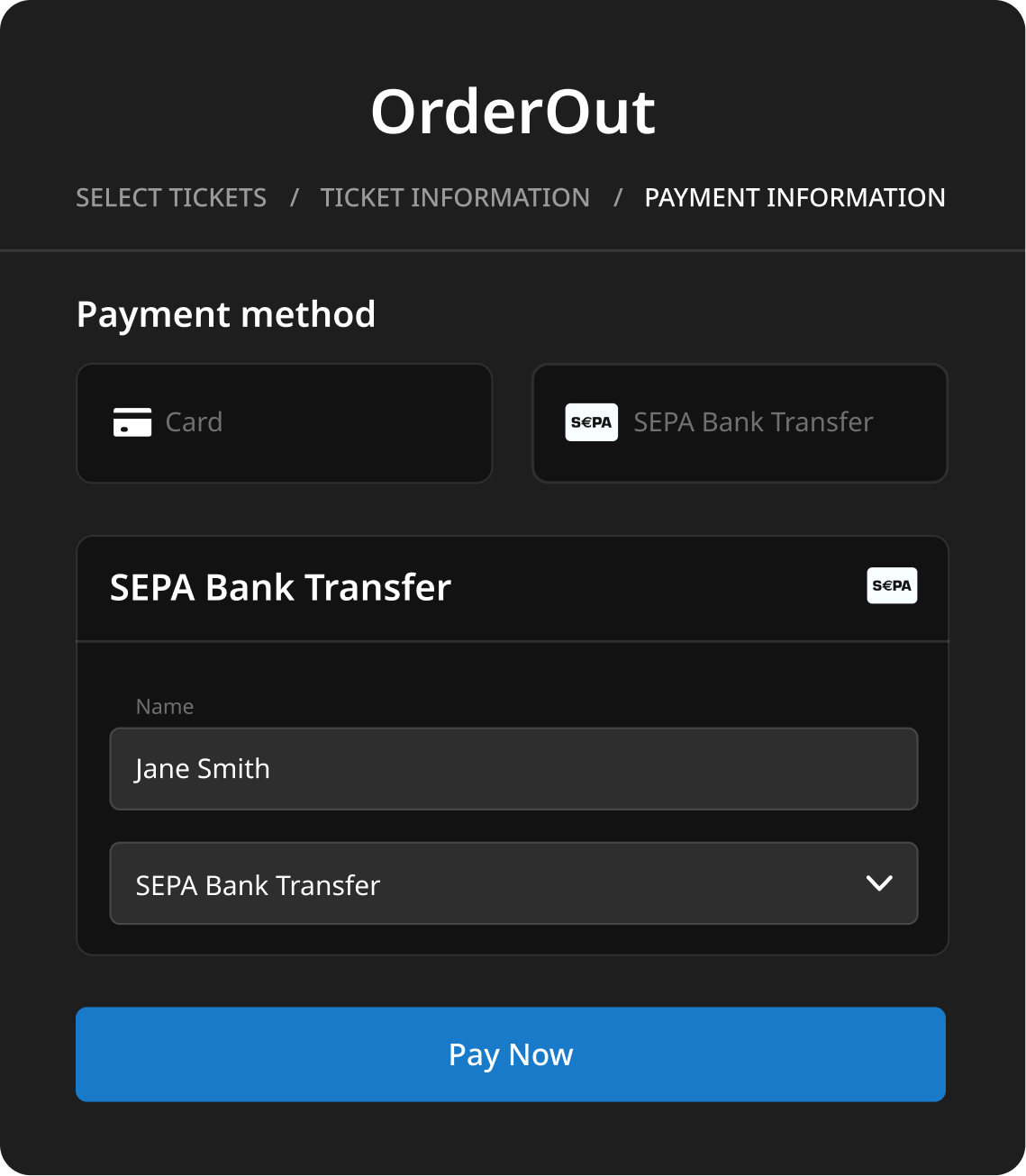

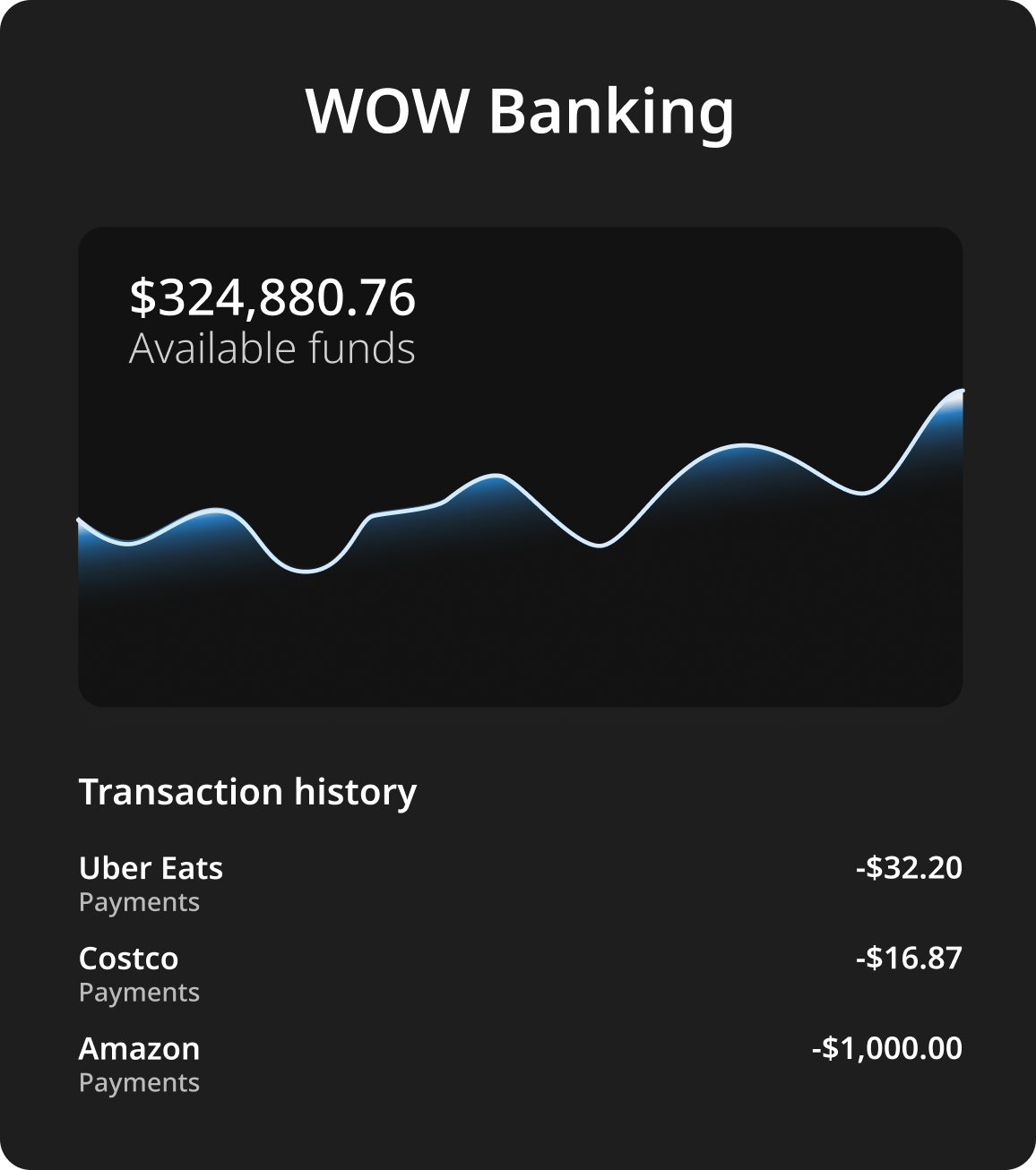

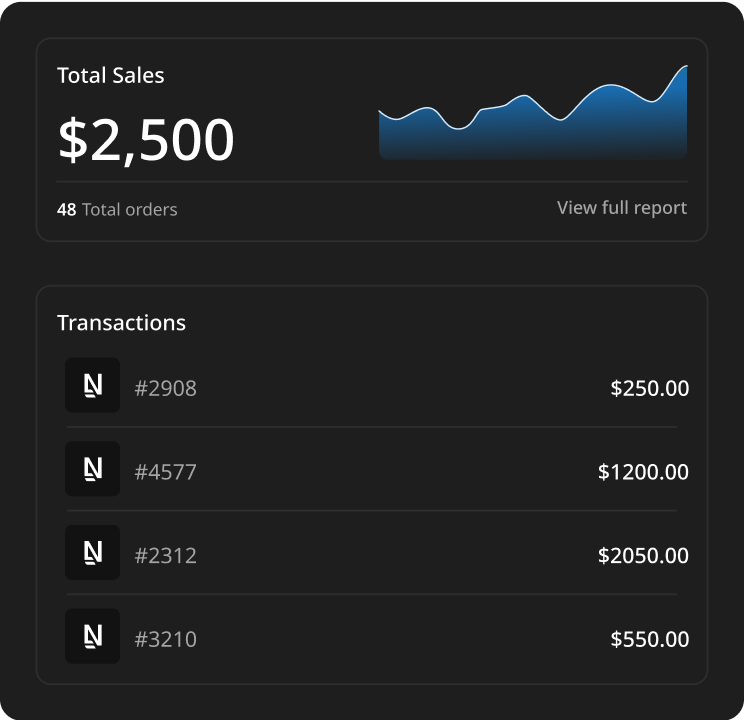

Boost your business revenue by integrating financial

services like payments and banking services while expanding your offerings with card programs

and loans to enhance user experience and unlock

new revenue streams.